Trump Administration’s Housing Affordability Plan Faces Widespread Criticism from Economists and Housing Experts

The Trump administration has introduced a controversial solution to America’s housing affordability crisis: a 50-year mortgage option that would extend loan terms two decades beyond the traditional 30-year standard. While Federal Housing Finance Agency Director Bill Pulte enthusiastically called the proposal “a complete game changer,” the announcement has sparked immediate backlash from economists, policymakers, and housing experts who warn that the benefits may be vastly outweighed by significant financial drawbacks for homebuyers.

The One Notable Benefit: Lower Monthly Payments

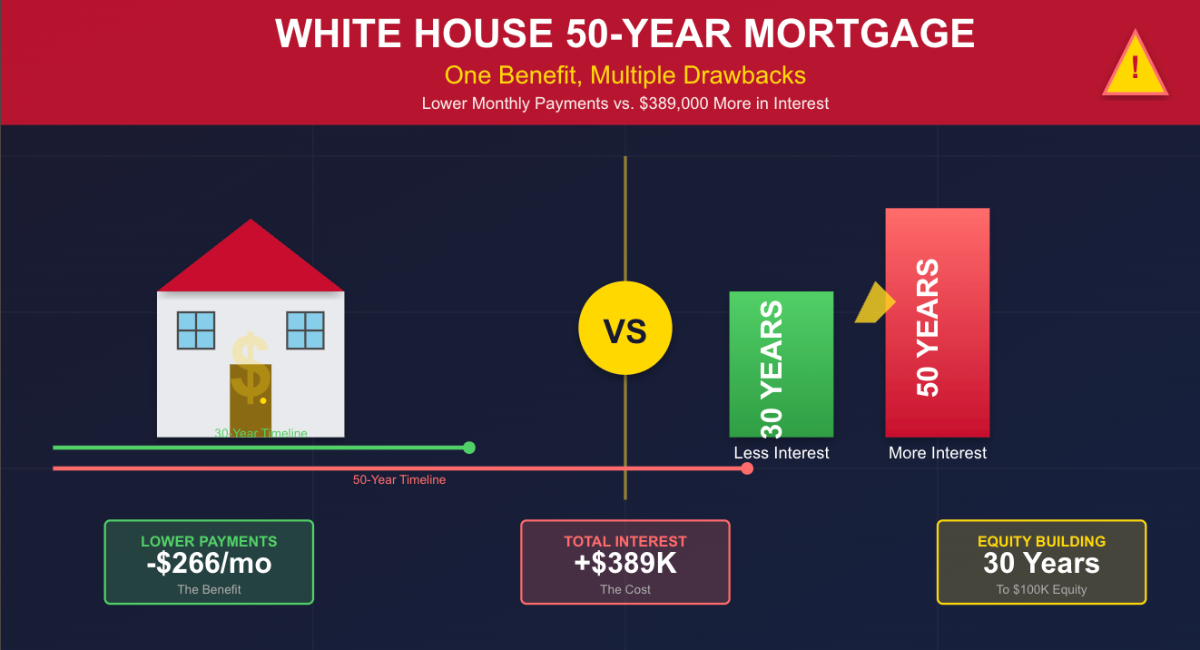

The primary advantage of a 50-year mortgage is straightforward—it reduces monthly payments. For a home priced at the current national average of $415,200, with a standard 10% down payment and an average interest rate of 6.17%, monthly payments would drop from $2,288 for a 30-year mortgage to $2,022 for a 50-year mortgage. That represents a savings of approximately $266 per month.

For prospective buyers currently priced out of the market, this reduction in monthly obligations could potentially make homeownership more accessible in the short term. With median U.S. households currently spending approximately 39% of their monthly income on mortgage repayments—well above long-term affordability benchmarks—even a few hundred dollars in monthly savings could theoretically help more Americans qualify for home loans.

Understanding the 50-Year Mortgage Proposal

The Federal Housing Finance Agency oversees Fannie Mae and Freddie Mac, which buy and insure the vast majority of mortgages in the country. Under Pulte’s proposal, these government-sponsored enterprises would begin backing 50-year mortgage products, giving homebuyers an option beyond the standard 30-year fixed-rate mortgage that has been the default way to buy a home since the New Deal era.

President Trump shared a graphic online comparing his proposal to the 30-year mortgage policies championed by President Franklin D. Roosevelt during the New Deal, framing the 50-year mortgage as an innovative solution to a modern crisis. However, the historical comparison may overlook crucial differences in economic conditions and homebuyer demographics between the 1930s and today.

The Major Drawbacks: Why Experts Are Concerned

Drawback #1: Massive Increase in Total Interest Paid

The most significant criticism of the 50-year mortgage proposal centers on the dramatic increase in total interest costs over the life of the loan. A borrower would pay roughly an additional $389,000 in interest over the life of a 50-year mortgage compared to a 30-year mortgage, according to Associated Press analysis.

John Lovallo with UBS Securities noted that extending a mortgage from 30 years to 50 years could double the dollar amount of interest paid by the homebuyer on a median-priced home over the life of the loan. This isn’t just a marginal increase—it represents a fundamental shift in the cost of homeownership that could trap borrowers in decades of debt.

Drawback #2: Severely Delayed Equity Accumulation

Perhaps even more concerning than the increased interest costs is how a 50-year mortgage would slow equity building. Because even more of the monthly payment on a 50-year mortgage would go toward interest on the loan, it would take 30 years before a borrower would accumulate $100,000 in equity, not including home price appreciation and the down payment. That’s compared to 12-13 years to accumulate $100,000 in equity when paying off a 30-year mortgage.

Chris Hendrix, senior vice president for the home loans unit of NBKC Bank in Kansas City, explained: “You’re going to be paying almost all interest for the first 10 years. It’s really akin to an interest-only loan at that point”.

This delayed equity accumulation fundamentally undermines one of the primary benefits of homeownership: building wealth through property ownership. For first-time homebuyers hoping to leverage their initial purchase into future real estate investments or tap into home equity for other financial needs, a 50-year mortgage could significantly delay or derail those plans.

Drawback #3: Life Expectancy and Generational Debt Concerns

The average age of a first-time homebuyer has been creeping up for years and is now roughly 40 years of age. The median age for a first-time homebuyer is 40 years old right now, meaning the typical first-time homebuyer is just as close to collecting Social Security as they are to graduating from high school.

A 50-year mortgage would be difficult to underwrite for a bank for a 40-year-old first-time homebuyer, who would be 90 years old by the time that home is paid off. The average life expectancy of an American is now roughly 79 years, meaning there’s 11 years of life expectancy not covered in a 50-year loan.

This creates a troubling scenario where mortgage debt could be passed to a borrower’s children or heirs. Mike Konczal, senior director of policy and research at the Economic Security Project, stated: “It’s typically not a goal of policymakers to pass on mortgage debt to a borrowers’ children”.

Drawback #4: Doesn’t Address Root Causes of Housing Crisis

A 50-year mortgage does nothing to solve one critical issue when it comes to housing affordability—the lack of supply of homes. Housing experts widely agree that America’s affordability crisis stems primarily from insufficient housing inventory, restrictive zoning regulations, and construction costs—not from loan term structures.

States like California and cities like New York have recently passed legislation or made regulatory changes to allow builders to build homes faster with less regulatory red tape. These supply-side solutions address the fundamental problem, whereas extended loan terms simply redistribute the existing scarcity.

Richard Berner, former director of the U.S. Office of Financial Research, stated: “This is not the best way to solve housing affordability. The administration would do better to reverse tariff-induced inflation, which is keeping the rates on existing mortgages high, and to encourage the expansion of housing supply by promoting homebuilding”.

Drawback #5: Legal and Regulatory Barriers

Under the Dodd-Frank Act, the mortgage giants Fannie Mae and Freddie Mac cannot insure a mortgage that is longer than 30 years, so any 50-year mortgage would be considered a “non-qualifying mortgage” and would be more difficult to sell to investors.

Under the Dodd-Frank Act, passed after the 2008 housing crisis, loan terms cannot exceed 30 years. This means Congress would have to amend U.S. financial laws in multiple places to allow for 50-year mortgages, and there seems to be little appetite for Congress to take this on immediately.

The legal obstacles aren’t merely procedural—they exist because regulators sought to prevent the types of risky lending practices that contributed to the 2008 financial crisis. Removing these safeguards could expose the housing market to new vulnerabilities.

The Housing Affordability Crisis Context

To understand why the White House is considering such a dramatic change to mortgage lending, it’s important to recognize the severity of the current housing affordability crisis. With 30-year fixed rates remaining stuck above 6% for more than three years, high homeownership costs have kept many would-be homebuyers out of the market.

At this point, typical homeowners spend 39% of their income on housing, well above the 30% affordability threshold recommended by financial experts, according to Redfin. Mortgage rates have eased this year but are still above 6%, about twice the pandemic-era lows. Home prices averaged $410,800 in the second quarter, about 25% higher than in early 2020.

Meanwhile, the “lock-in effect” has prevented many prospective sellers from putting their homes on the market because they don’t want to give up the ultra-low rates they secured before borrowing costs jumped in 2022. This has further constrained inventory and driven up prices.

Political Reception and Internal Tensions

The proposal wasn’t fully vetted by top Trump administration officials and wasn’t ready to be made public, sources told CBS News. Some Trump officials this week vented their frustration with Pulte over the move. One source said Mr. Trump was lukewarm about the suggestion but announced it “to get Pulte to shut up about it”.

Even among Trump’s MAGA base, the reception has been mixed. Fox News’ Laura Ingraham told Trump this week that the proposal “has enraged your MAGA friends,” citing “significant MAGA backlash, calling it a giveaway to the banks and simply prolonging the time it would take for Americans to own a home outright”.

A Counterargument: The Rent vs. Own Perspective

Not everyone in the mortgage industry views the proposal as entirely negative. Phil Crescenzo, a vice president at Nation One Mortgage Corporation, said the industry has been overly negative on the 50-year mortgage proposal. While homeowners would build equity more slowly than with a shorter loan, Crescenzo noted that, in some cases, a 50-year mortgage could still be better than renting and never accumulating any home equity at all.

“It’s not like somebody would have to stay in that loan forever. It’s a starting point,” Crescenzo said, pointing out that homeowners always have the option to refinance their loans. “If I had the option where I’m renting the home or I can get a 50-year mortgage and I’m not going to gain much equity for a couple of years, I would still take that deal versus renting”.

This perspective acknowledges that for some buyers, the choice isn’t between a 30-year mortgage and a 50-year mortgage—it’s between a 50-year mortgage and continued renting. In markets where rental costs rival or exceed mortgage payments, any pathway to eventual homeownership might be preferable to perpetual renting.

The Historical Context: Why 30 Years?

The 30-year mortgage is a uniquely American financial product and the default way to buy a home since the New Deal. Politicians and policymakers at the time wanted to create a standardized mortgage that borrowers could afford and pay off during their working years, when the average lifespan for an American was 66 years old.

The 30-year term was carefully designed with demographic and economic realities in mind. Homebuyers in the 1930s could reasonably expect to pay off their homes before retirement and well within their expected lifespan. Today’s proposal extends far beyond these original considerations.

Lessons from Auto Loans: A Cautionary Tale

Other parts of the financial system have extended loan terms, to mixed results. The seven-year auto loan has become increasingly common as car prices have risen and Americans keep their cars longer.

The expansion of auto loan terms offers a warning about the unintended consequences of extended financing. While longer auto loans have made monthly payments more manageable, they’ve also contributed to negative equity situations where borrowers owe more than their vehicles are worth, trapped in depreciating assets with years of payments remaining. The parallel to 50-year mortgages is concerning, particularly given the much larger financial stakes involved in home purchases.

What About Construction Costs and Tariffs?

There’s also the raw cost of homebuilding in the country. Products such as steel, lumber, concrete, copper and plastics that go into home construction are now subject to tariffs under President Trump.

These tariff policies directly contradict efforts to improve housing affordability. By increasing the cost of construction materials, tariffs drive up home prices and construction costs, making the underlying affordability problem worse even as the administration proposes financing solutions.

Alternative Solutions Housing Experts Recommend

Rather than extending loan terms, housing policy experts consistently recommend several alternative approaches to improving affordability:

Supply-Side Solutions:

- Streamline zoning regulations to allow more housing construction

- Reduce permitting timelines and regulatory barriers

- Incentivize affordable housing development through tax credits and subsidies

- Convert underutilized commercial properties to residential use

Demand-Side Assistance:

- Expand down payment assistance programs for first-time buyers

- Provide targeted tax credits for first-time homebuyers

- Increase funding for affordable housing initiatives

- Support community land trusts and other alternative ownership models

Interest Rate and Monetary Policy:

- Federal Reserve policies aimed at stabilizing interest rates

- Government-backed programs offering below-market rate mortgages to qualified buyers

- Expansion of existing programs like FHA, VA, and USDA loans

The Refinancing Safety Net Argument

Proponents of the 50-year mortgage emphasize that borrowers wouldn’t be locked into unfavorable terms permanently. The argument suggests that buyers could start with a 50-year mortgage to get into the market, then refinance to a shorter-term loan when their financial situation improves or when interest rates drop.

However, this strategy depends on several uncertain factors. Refinancing requires closing costs (typically 2-5% of the loan amount), qualifying income and credit scores, and favorable interest rate environments. For many buyers already stretching to afford homes, these refinancing opportunities may remain perpetually out of reach.

Impact on Wealth Building and Generational Wealth Gap

The wealth-building potential of homeownership has long been considered a cornerstone of the American middle class. Home equity represents the largest component of wealth for most American families. By dramatically slowing equity accumulation, 50-year mortgages could undermine this wealth-building mechanism precisely when Americans need it most.

This concern is particularly acute for communities of color and first-time buyers, who have historically faced barriers to homeownership and wealth accumulation. While the policy aims to increase access to homeownership, the long-term financial consequences could inadvertently widen wealth gaps rather than narrow them.

What Happens If Interest Rates Change?

The proposal assumes relatively stable interest rates over an unprecedented 50-year period. However, the extended timeframe exposes borrowers to decades of economic uncertainty. While fixed-rate mortgages protect against rate changes during the loan term, the opportunity cost of being locked into a single rate for half a century could be substantial.

Borrowers who take out 50-year mortgages during periods of elevated rates may find themselves paying above-market rates for decades, even as economic conditions change. The typical refinancing safety net may not be accessible to many borrowers, particularly those who barely qualified for their original loans.

Industry Response and Banking Concerns

The banking and mortgage industry has expressed mixed reactions to the proposal. While longer loan terms could potentially expand the pool of qualified borrowers, they also introduce new risks for lenders. The extended timeframe increases exposure to default risk, property value fluctuations, and economic cycles.

Banks may respond by requiring higher interest rates on 50-year mortgages to compensate for increased risk, potentially eliminating much of the monthly payment benefit. They might also impose stricter underwriting standards or require larger down payments, which could negate the accessibility advantages the policy aims to create.

Timeline and Implementation: What’s Next?

No other details about the proposal have been released, and the legal pathway to implementation remains unclear. Given the Dodd-Frank restrictions and the need for congressional action, any actual implementation of 50-year mortgages could be years away.

Pulte said on X that the introduction of a 50-year mortgage was just a “potential weapon,” among other solutions the White House has considered to combat high housing prices. This suggests the administration may be exploring multiple approaches, though details on alternative policies remain scarce.

The Verdict: Band-Aid or Solution?

The White House’s 50-year mortgage proposal represents a fundamental tension in housing policy: should government intervention focus on making existing home prices more affordable through creative financing, or should it address the underlying supply and cost issues driving unaffordability?

Critics argue that extending mortgage terms to 50 years is the equivalent of treating symptoms rather than curing the disease. While lower monthly payments may help some buyers qualify for loans in the short term, the long-term costs—nearly $400,000 in additional interest, three decades to build meaningful equity, and potential generational debt—suggest this “game changer” may ultimately change the game in ways that harm rather than help American homebuyers.

The singular benefit of lower monthly payments must be weighed against multiple significant drawbacks: doubled interest costs, severely delayed equity building, misalignment with life expectancy, failure to address housing supply shortages, and legal barriers to implementation.

For prospective homebuyers navigating the current market, the message is clear: if 50-year mortgages become available, proceed with extreme caution. What appears to be an affordability solution may actually be an expensive trap that extends debt obligations well into retirement and undermines the wealth-building potential that makes homeownership worthwhile in the first place.